Market makers provide liquidity for digital assets and are a vital component of any exchange. However, it is a complicated and highly risky job that requires a ninja-level of skills and significant resources. Luckily, some new solutions are making this important role more accessible.

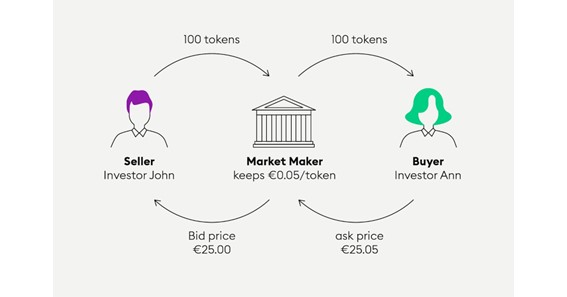

In the past, market makers worked around the clock to reduce price volatility by providing the right level of liquidity. This was done by posting buy and sell orders on the order book, matching them and absorbing the impact of the market movements. They are also responsible for ensuring that there is always enough volume on the buy and sell side.

But what if this process could be democratized? What if regular individuals could function as market makers through simple software? This is the idea behind decentralized trading protocols such as Uniswap, Sushi, and Curve, which aim to eliminate the need for market makers through the use of smart contracts.

The emergence of these decentralized market-making solutions will significantly boost the liquidity of crypto markets and make it easier for anyone to buy or sell cryptocurrencies. They do this by removing the need for centralized exchanges and their traditional order books, which often feature large spreads. They are also capable of reducing the risk of fraud and market manipulation.

These protocols have the potential to revolutionize the cryptocurrency market, and they will likely play a big role in the future of blockchain technology. But for now, there are still plenty of hurdles to overcome. One of the main challenges is that they require substantial trading capital, which is not an easy feat in the volatile crypto market. However, the development of more sophisticated smart contract technologies and improved cryptographic algorithms may help to address this issue in the future.

Click Here – The Ultimate Guide to Using Roof Sealant for Campers: Protect Your RV with Liquid Rubber Technology

As the demand for market maker crypto assets continues to rise, it’s vital that there is sufficient liquidity on the exchanges to allow traders to trade them. But without dedicated market makers, it would be difficult to ensure this. This is because if there is a sudden surge in demand, the price of the asset can skyrocket, which may not be sustainable in the long term. A market maker can help to absorb this demand by selling the cryptocurrency to buyers, which will mitigate the price increase and prevent the market from becoming too volatile.

Traditionally, market makers have been hired by exchanges and quoted bid-ask asset prices throughout the day in order to attract traders to their platforms. But as the market for crypto becomes increasingly regulated, this model is being challenged. Many MMs are beginning to question their reliance on exchanges for liquidity and are seeking out alternative ways to support the market. For example, some are introducing additional sources of liquidity through private pools and are offering incentives such as equity to their investors. But even with this shift in approach, it is clear that MMs remain crucial to the crypto industry. Without them, the market would quickly become unattractive to traders.