Money laundering is a complicated process that entails 3 stages of money laundering aimed at changing the source of money and making it appear legitimate. Each year, criminals around the world launder anywhere between $800 million and $2 trillion. Although financial institutions and authorities have made significant progress in combating money laundering still there is difficulty in detecting the certain stage of money laundering. In this guest post, we’ll look at the difficulties of detecting money laundering and what can be done to strengthen anti-money laundering (AML) efforts.

What are the Stages of Money Laundering?

It is very important to have a proper understanding of the concept in order to comprehend the reasons behind the frequently used technique of money laundering. Money laundering is the process of changing the source of illegally obtained funds so that they appear to be from legitimate sources. Money laundering, if not done correctly, can have a significant impact on the economy, security, and society in general. It acts as a catalyst for a variety of crimes, including those committed by drug dealers, terrorists, arms dealers, corrupt officials, and others.

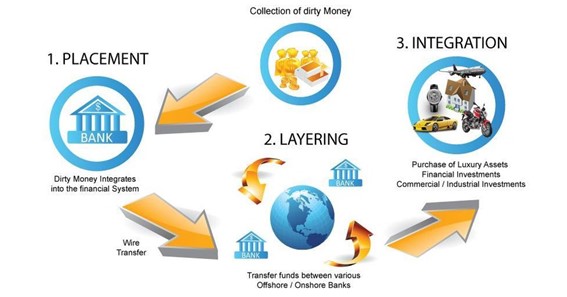

There are 3 stages of money laundering.

- Placement: The first stage of money laundering is known as “placement,” and it involves the introduction of illegal funds into the legitimate financial system through methods such as deposits or wire transfers. During this stage, it is critical to conceal the source and ownership of the funds, which is often accomplished by dividing the funds into smaller sums and depositing them into multiple accounts. Buying high-value assets is another common method for separating illegal proceeds from their source.

- Layering: Layering is an important stage of the money laundering process because it aims to separate the proceeds of criminal activity from their source through complex financial transactions. Its primary goal is to give illegal funds an illusion of legitimacy, making detection difficult. During this stage, multiple financial intermediaries and transactions are used to intentionally confuse anti-money laundering (AML) measures. The common techniques used during layering

- Currency exchange,

- Inter-bank transfers,

- Structuring and Smurfing,

- Cryptocurrency trading (Cryptocurrency worth $8.6 billion was laundered by criminals in 202)

- High-value purchases,

- Wire transfers between different accounts and countries,

- The formation of shell companies,

- Investment in businesses with minimal paperwork,

- Use of money mules (Approximately 2,300 money mules were targeted by US law enforcement in 2020 as part of a global money laundering crackdown).

- Integration: The final stage of money laundering in the process of concealing illicit proceeds through legitimate transactions is integration. During this stage, illegally obtained funds are reintroduced into the economy, giving the impression that they have legitimate origins. This allows criminals to “clean” dirty money, invest it, and profit from it without being detected. During the integration stage, it is difficult to distinguish between legal and illegal funds.

The Most Difficult Stage of Money Laundering

The second stage in the money laundering process is layering, which aims to make illegal money more difficult to detect and remove from illegal locations. This is the most difficult and perplexing step in the bathing process. The main goal is to create enough confusion that even skilled investigators will struggle to distinguish between legitimate business and dirty money.

During layering, the illicit money is mixed with the right money, or it is constantly moved from one account to another. This includes numerous transactions to conceal the source of the money and effectively launder it. Layering can be accomplished through a variety of methods, such as playing small games in casinos with illegally obtained money while buying and withdrawing chips can make the money appear legitimate. good. Another option is to invest in the stock market and explore various financial products or foreign exchange. For example, a money laundering transaction in US dollars will be more challenging to detect if it is later converted to UK pounds and then to Japanese yen.

The layering strategies vary depending on the plan being worked on, which is frequently detailed and dramatic. Money can be transferred across international borders from many accounts in many banks worldwide. In some cases, the laundress modifies the delivery as payment for goods or services to make them appear more professional.

How to Detect Layering with AML Solutions?

KYC and AML teams play a critical role in detecting layering as part of the money laundering process. Between 2021 and 2025, the anti-money laundering software market is anticipated to grow at a CAGR of 14%. Here is how they can effectively detect layering:

- Contextual Analysis: KYC and AML teams can bring information about a customer’s situation, such as their transactions or other details in official documents, to the table. These contextual indicators can aid in the identification of patterns or inconsistencies that indicate potential layering.

- Red flag Monitoring: AML programs can set up red flag indicators to monitor suspicious activity such as slow and frequent deposits and legitimate withdrawals. These patterns are common in layering and may warrant further investigation.

- Effective KYC and CDD procedures: Understanding a customer’s risk profile requires the implementation of a thorough Know-Your-Customer (KYC) and Customer Due Diligence (CDD) process. To spot potential layering, an AML program must examine the customer’s identity and assess the reliability of their financial program.

- Automated AML Solutions: Using automated AML solutions can lessen the workload of KYC and AML teams given the substantial amount of data involved in layering detection. Large transactions can be processed quickly by these solutions, which also reduce errors and boost accuracy in spotting suspicious activity.

Bottom Line:

For financial institutions and law enforcement agencies, the layering stage of money laundering continues to be a formidable challenge. We can improve our effort to combat money laundering and safeguard the integrity of the international financial system by comprehending the particular complexities of this stage and putting in place effective KYC/AML measures. In this ongoing fight against financial crime, cooperation, technological advancements, and strict compliance procedures are crucial to staying ahead.