In the digital age, running a business has never been easier. You can reach customers without needing a physical location, storefront, or face-to-face interaction.

But if you’re an online seller, how do you get paid? Many ways allow you to accept payments for your products and services online. Read more to explore what is payment processing for Ecommerce and how payment processing works so that you can select the best one for your business!

What is payment processing?

Payment processing is the process of accepting credit card payments from customers. It’s a way for you to make money from your business, and it’s also a way for your customers to pay you.

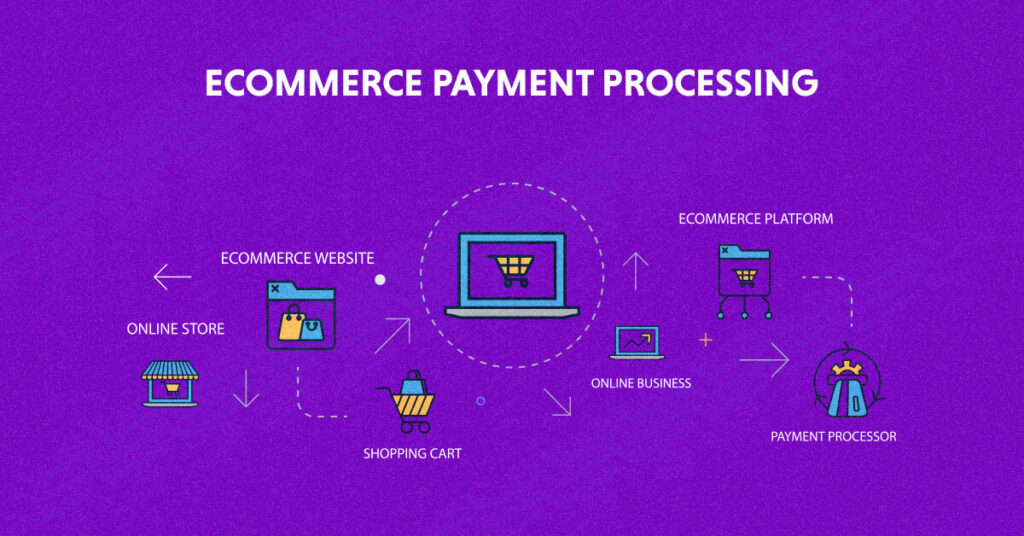

How does e-commerce payment processing work?

First, you should know how the process works and the two types of payment processing: direct and indirect.

Direct payment processing occurs when your customer pays their credit card bill, which means that the money is paid directly from their account. Indirect payment processing would occur if you, as a merchant, were to pay for their purchase with your funds and collect the cost from them later.

Click here – 4 Reasons To Get Umbrella Insurance

What types of payment processing do you need for your

business?

Payment processing is an integral part of any eCommerce business. It helps you close deals with customers and turns them into buyers if you sell products online.

However, before you begin accepting payments through your website, there are several types of payment processing to consider:

- Offline (traditional) payments

- Online payments

- Mobile payments

- Payment processing for businesses that accept cryptocurrency such as Bitcoin

How do I choose a payment processor that’s right for my business?

Payment processing for E-commerce happens on software that manages all payments within seconds. When looking for a payment processor, it’s essential to consider the reputation of your prospective processor. You want to ensure that they offer the features you need for better customer experience and satisfaction.

Here are some tips to look out for:

- The company has been in the market for a while and has a good track record

- They have some of the most competitive rates and fees

- Their customer service is responsive and easy to reach by phone or email

Tips for choosing online payment processors

- You also must ensure that the company you’re considering has a good reputation with customers and merchants. An excellent way to do this is by reading reviews from other businesses on Yelp or Trustpilot and checking out their Better Business Bureau profile (if available).

- Safety is the most crucial part of any payment gateway, and you should always look for a processor that provides safe transactions from both ends of payments.

- Finally, remember that small mistakes can cause major problems; always read contracts carefully before signing anything!

Click here – 5 Things You Need To Know Before Adopting A Low-Code Platform

Conclusion

Payment processing is a process that is directly related to your sales and understanding the processor before choosing the suitable payment processor for your business. There are many factors to consider, but the above are some of the most important ones so that you’re better prepared when it comes time to make your decision.